The Infrastructure Play Public Companies Are Missing: How the GENIUS Act Opened a $255 Trillion Tokenization Window

We're watching a structural shift in capital markets that most public companies haven't noticed yet.

On July 18, 2025, the GENIUS Act created the first federal regulatory framework for stablecoins in the United States. The legislation did something critical: it removed the regulatory ambiguity that had frozen institutional adoption of digital asset infrastructure.

This wasn't just a crypto milestone. It was the starting gun for a race to tokenize traditional securities.

The numbers tell the story. Stablecoin transfer volume hit $27.6 trillion in 2024—more than Visa and Mastercard combined. Following the GENIUS Act's passage, global crypto assets briefly surpassed $4 trillion. But the real opportunity isn't in cryptocurrency speculation.

It's in what comes next: the tokenization of real-world assets, including equity securities issued by public companies.

The DTCC Just Changed the Game for Traditional Securities

On December 11, 2025, the Depository Trust Company received something unprecedented: a No-Action Letter from the SEC allowing it to offer pilot tokenization services for highly liquid assets.

This matters because the DTCC is the central securities depository for the United States. When it starts offering tokenization services in 2026, it will mark the first time tokenized security entitlements held through a CSD can be held by participants on public and private-permissioned blockchains.

The infrastructure is being built. The regulatory clarity is emerging. The institutions are moving from the sidelines into active participation.

In 2025, the Office of the Comptroller of the Currency received 14 de novo charter applications for limited purpose national trust banks—nearly matching the total from the prior four years combined. Many of these applications involve fintech and digital-asset firms seeking to move payments, custody, lending, or stablecoin issuance inside a regulated banking perimeter.

Banks aren't watching anymore. They're building.

Why Tokenization Creates Structural Advantages for Issuers

Tokenization converts ownership rights in an asset into a digital token on a blockchain. For securities, this creates several immediate advantages:

Fractional ownership becomes technically simple. A $10 million bond can be divided into 10,000 tokens worth $1,000 each, or 10 million tokens worth $1 each. The blockchain handles the accounting.

Settlement happens in minutes, not days. Traditional securities settlement takes T+2 (two business days after the trade date). Tokenized securities can settle in real time, reducing counterparty risk and freeing up capital.

Secondary market liquidity improves. Tokenized securities can trade on regulated Alternative Trading Systems with immediate settlement. This is particularly valuable for securities issued under Regulation A+, which allows trading on day one.

Operational costs drop. Digital-native bonds and equities issued on blockchain platforms reduce underwriting costs and improve time-to-market. The infrastructure handles compliance, cap table management, and transfer restrictions programmatically.

The total value of tokenized real-world assets reached approximately $33 billion as of October 2025. Projections suggest the market could expand to $255 trillion as existing collateral use cases migrate to tokenized infrastructure.

That's not hype. That's the total value of assets that could benefit from the operational advantages tokenization provides.

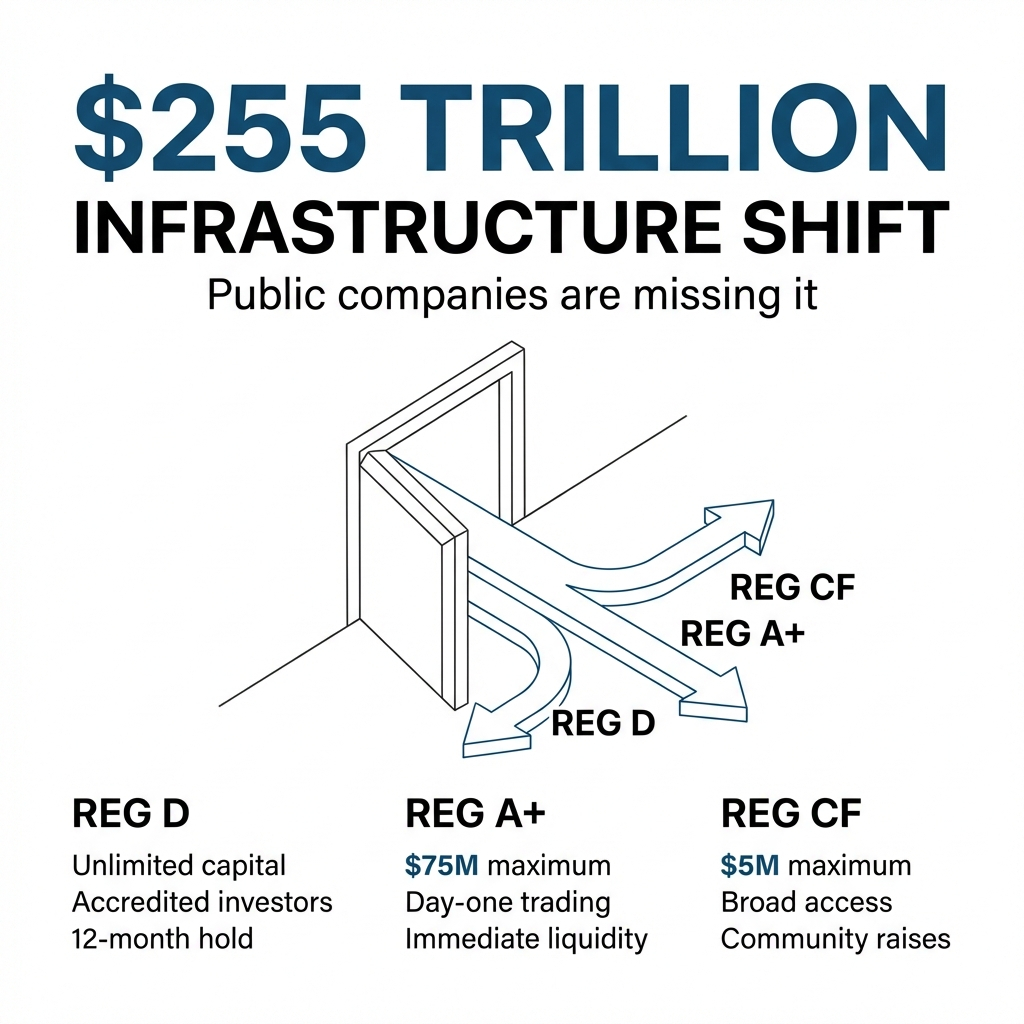

The Exemption Stack: How Public Companies Can Issue Tokenized Securities Without Traditional Registration

Here's what most public companies don't realize: you don't need to register tokenized securities with the SEC if you use existing exemptions.

Three exemptions create particularly compelling opportunities:

Regulation D (Rule 506(b) and 506(c))

Regulation D allows companies to raise unlimited capital from accredited investors without registering the offering. Rule 506(b) permits up to 35 sophisticated but non-accredited investors and prohibits general solicitation. Rule 506(c) allows general solicitation but restricts sales to verified accredited investors only.

For tokenized securities, Reg D provides a fast path to capital with minimal disclosure requirements. The trade-off is a 12-month holding period before securities can be freely traded.

Regulation A+ (Tier 1 and Tier 2)

Regulation A+ allows U.S. and Canadian companies to raise up to $75 million in a 12-month period from an unlimited number of unaccredited investors. The requirements are relaxed compared to a registered IPO, but the exemption provides something valuable: immediate liquidity.

Tokenized Reg A+ securities can trade on day one of issuance on regulated Alternative Trading Systems, both in the U.S. and overseas. This eliminates the holding period restriction that applies to Reg D offerings.

For public companies looking to issue tokenized securities that trade immediately, Reg A+ creates a clear pathway.

Regulation Crowdfunding

Regulation Crowdfunding allows companies to raise up to $5 million in a 12-month period from both accredited and non-accredited investors through SEC-registered funding portals. The exemption is designed for smaller raises but provides access to a broad investor base.

For tokenized offerings, Reg CF works well for community-oriented raises or for testing market demand before pursuing larger capital formation strategies.

What This Means for Public Companies Right Now

The GENIUS Act didn't just regulate stablecoins. It created regulatory certainty for the infrastructure that enables tokenized securities.

A payment stablecoin issued by a permitted payment stablecoin issuer is now explicitly not a "security" under federal securities laws or a "commodity" under the Commodity Exchange Act. This clarity removes a major friction point for tokenization platforms, which need stablecoins to facilitate settlement.

Public companies can now issue tokenized securities through established exemptions, settle trades in stablecoins with regulatory certainty, and access secondary market liquidity through regulated Alternative Trading Systems.

The infrastructure exists. The regulatory framework is clear. The institutions are participating.

What's missing is awareness among public companies that this opportunity exists.

The Strategic Question Public Companies Should Be Asking

The question isn't whether tokenization will become standard infrastructure for securities issuance. The institutions moving into this space have already answered that question.

The question is: which public companies will move early enough to gain structural advantages from lower issuance costs, faster settlement, and improved secondary market liquidity?

We're in the window where early adopters gain disproportionate benefits. The DTCC's pilot program starts in 2026. Banks are applying for charters to offer digital asset services. The regulatory framework is stabilizing.

Public companies that understand how to navigate this landscape—how to structure tokenized offerings under existing exemptions, how to work with regulated Alternative Trading Systems, how to leverage stablecoin infrastructure for settlement—will capture advantages that compound over time.

The infrastructure play isn't in the future. It's happening now.

How We Help Public Companies Navigate Tokenization

TNCDP is the infrastructure provider for public companies seeking to issue tokenized securities through established regulatory exemptions.

We connect public companies with the frameworks, systems, and expertise needed to structure compliant tokenized offerings under Regulation D, Regulation A+, and Regulation Crowdfunding.

Our network includes regulated Alternative Trading Systems, transfer agents with tokenization capabilities, legal counsel specializing in digital securities, and technology providers building the infrastructure for blockchain-based securities issuance.

We don't sell software. We provide access to the ecosystem that makes tokenized securities issuance operationally feasible for public companies.

If you're a public company exploring tokenization as a capital formation strategy, we can show you how the infrastructure works and connect you with the specific service providers your situation requires.

The window is open. The question is whether you'll move while the structural advantages are still available to early adopters.

Contact us to discuss how tokenized securities issuance fits into your capital formation strategy.